IIF has set targets for greenhouse gas emissions reduction toward realization of 2050 net-zero. Based on validation by a third party specialized institution, a target has been set for reduction of absolute GHG emissions by 42% compared to FY2021 levels by 2030. The target has been certified as a science-based target by the Science Based Targets initiative (SBTi).

Reduce absolute Scope 1+2 emissions by 42% by 2030 (compared with 2021)*

Aim for net-zero absolute GHG emissions throughout the entire value chain by 2050

* SBTi Certified Target

Please refer to Award from External Party for further details.

To realize our Mission Statement of “Unlocking Real Assets’ Future,” we are highly aware of the importance of sustainability and are proactively promoting initiatives under our Sustainability Strategy of “Practicing Responsible Property Investment and Contributing to Solve Social Issues.”

We have established a Sustainability Promotion Structure to oversee and monitor sustainability activities, including those addressing environmental challenges such as climate change and natural capital.

The Paris Agreement is an international framework on climate change adopted in 2015. Its long-term goal is stated as holding the increase in the global average temperature to well below 2ºC above pre-industrial levels and sharing efforts to limit the temperature increase to 1.5ºC, and to achieve effectively zero greenhouse gas emissions.

Actions related to climate change accelerated in 2021. For example, the U.S.-hosted Leaders Summit on Climate was held, and climate change was discussed as the most important issue in the G7 Summit. In addition, in the 6th Evaluation Report, Working Group 1 Report published in August 2021, it was affirmed that “it is unequivocal that human influence has warmed the atmosphere, ocean and land.” Thus, it was revealed that significant reductions in greenhouse gas emissions are urgently needed to achieve the Paris Agreement goals. Under such circumstances, the 26th Climate Change Conference of the Parties (COP26) was held. The final agreement clearly states that the conference “reaffirms the goal to pursue efforts to limit the temperature increase to 1.5ºC,” indicating that not only governments but also industries will need to consider measures for the 1.5ºC target going forward.

KJRM (consisting of KJRM Holdings, KJR Management, and KJRM Private Solutions), under its “Sustainability Policy” (established in June 2013 and renamed from the “Responsible Property Investment Policy” in September 2023), states its commitment to implementing Responsible Property Investment (RPI), which integrates environmental, social, and governance elements into property investment. This concept of RPI is incorporated into and carried out throughout the entire period of the funds’ investment and management processes.

We believe that owning and managing properties in an environmentally conscious and socially responsible manner is an important strategy to enhance the value of investments by reducing the risks of regulatory non-compliance and loss of competitiveness, increasing the attractiveness of properties for tenants and purchasers, and improving profitability through cost reductions. Furthermore, we believe that this strategy also generates positive impacts on the environment and society.

In addition, we established the “Environmental Charter” in June 2013, which sets forth our environmental principles and action guidelines.

For further details, please refer to the Environmental Charter.

We are highly aware that environmental issues, including climate change, are critical challenges that have a significant impact on our business activities. We consider it essential to understand the relationship between our dependence and impacts on natural capital and to take into account environmental issues such as climate change and biodiversity when planning our initiatives.

To realize our mission statement of “Unlocking Real Assets’ Future,” we place strong emphasis on sustainability and are proactively advancing initiatives under our Sustainability Strategy of “Practicing Responsible Property Investment and Contributing to Solve Social Issues.” Research has made clear that the acceleration of economic activities exacerbates climate change, leading to abnormal weather events such as torrential rains, floods, and droughts. We recognize that addressing climate change as part of environmental challenges and working toward the achievement of net zero is a social responsibility required in the pursuit of our business activities.

The asset manager expressed its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)* in August 2019.

The matters resolved by and reported to the Sustainability Committee chaired by the Chief Sustainability Officer (CSO) are overseen and supervised by being reported as needed to the Board of Directors of KJRM Holdings, which is chaired by the President & CEO who also serves as CSO and meets at least once every three months, as well as the Board of Directors of the investment corporation, which meets at least twice a month in principle.

The Sustainability Committee, which held once a quarter in principle, identifies material risks and opportunities related to sustainability including climate change and natural capital, and plays a central role in sustainability activities by resolving policies, strategies, systems, and sustainability goals and monitoring performance.

For details, please refer to “Sustainability Promotion Structure”.

Dependencies and impacts as well as risks and opportunities on climate change and natural capital are sorted out in consideration of our business activities and then reviewed for the investment corporation, led by the sustainability staff of each division. Dependencies and impacts as well as identified risks and opportunities, along with their degree of impact, are reported to, and discussed and confirmed by the Sustainability Committee.

We led by the person in charge of sustainability issues, holds meetings (hereinafter referred to as "subcommittees") as necessary to discuss and examine in detail sustainability-related issues and promotion methods at the working level, either within the division or in cooperation with other divisions. Through the subcommittees, individual issues are discussed, and information is shared to raise awareness and understanding of the issues among those in charge, and to integrate sustainability considerations into the daily investment and management process.

Matters discussed and considered by the subcommittees are reported to the Sustainability Committee by each division, and the Sustainability Committee monitors that progress.

Moreover, the investment corporation collects and monitors monthly environmental data for properties. To work on initiatives for environmental matters, including metrics and targets and efforts to address climate change, and collect environmental data, we have established an environmental management system and strive to continually strengthen and improve our initiatives by implementing a PDCA cycle.

We operate the Risk Management Committee, in which senior management personnel serve as members. The Committee grasps and investigates matters related to major risks and formulates countermeasures and management policies. It checks the risks and opportunities affecting business operations, including climate change, at each division once every three months using a Risk Control Matrix (RCM), and reports to the committee for evaluation and management.

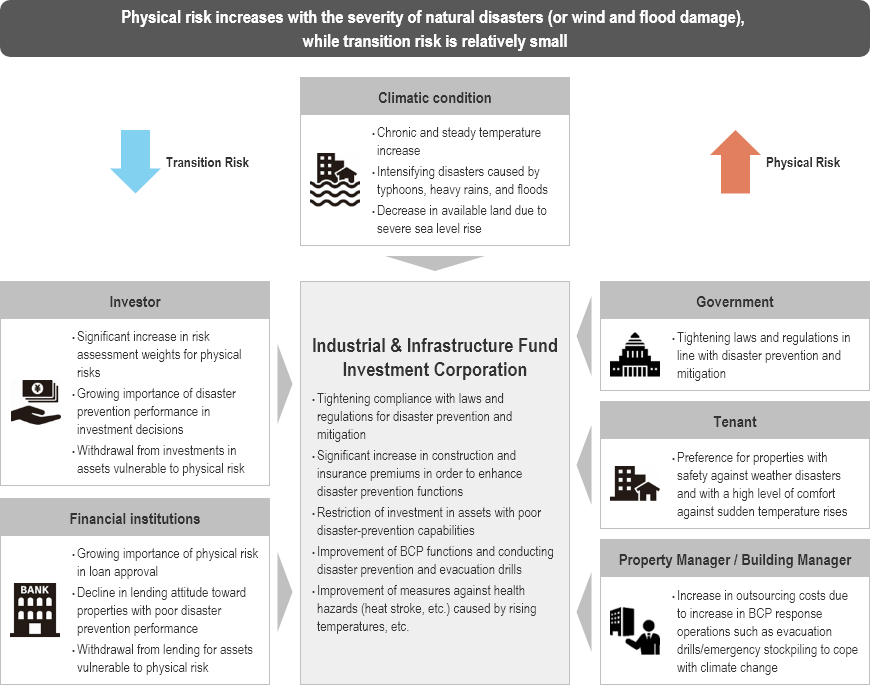

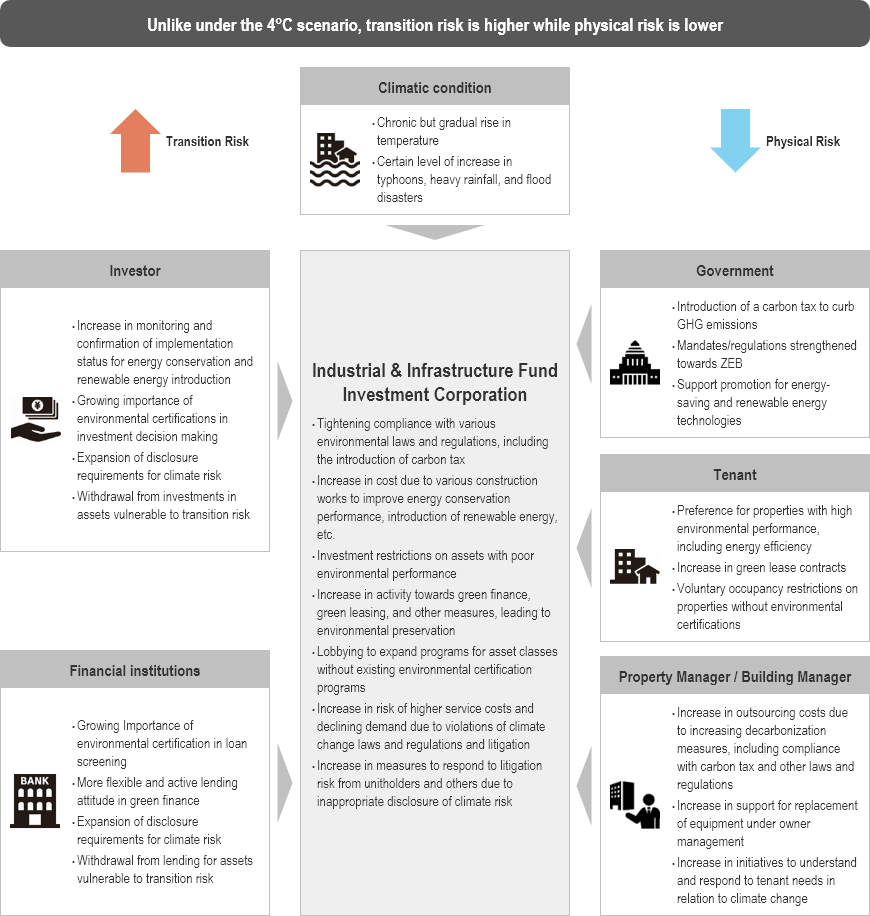

In examining the medium-to long-term financial impact of climate change, we assume world views surrounding IIF based on both 4°C and 1.5°C scenarios related to climate change.

Two scenarios, the 4°C and 1.5°C scenarios, are assumed based on the Paris Agreement's target for efforts to limit rise in temperature.

[Assumed scenario]

| 4°C scenario | Scenario assuming that initiatives for decarbonization are not to be further enhanced and disasters associated with climate change will become more serious | |

|---|---|---|

| Transition Risk | As a result of the lack of measures beyond the current mitigation measures, no new policies and regulations are introduced or strengthened compared to the 1.5°C scenario. It is assumed that stakeholders do not have a high level of interest in environmentally friendly measures. | |

| Physical Risk | As a result of a significant rise in temperatures and more intense rainfall, higher utility costs and flood damage to properties are expected, and measures focusing on disaster response are likely to be required. | |

| 1.5°C scenario | Scenario assuming that transition to a decarbonized society is to be socially reinforced and companies are expected to be more environmentally conscious. | |

|---|---|---|

| Transition Risk | Various policies and regulations, including the introduction of a carbon tax, will be strengthened, and environmental consideration and reporting will be required by stakeholders as well as evaluation based on the progress of initiatives. In the real estate sector, renewal to high-efficiency technology with low emissions and adoption of renewable energy, etc. will be required. |

|

| Physical Risk | Natural disasters are expected to be become more severe and frequent than at present, but to be smaller in magnitude than those of the 4°C scenario. | |

(Referenced climate change-related scenarios)

| Risk | Sources | 4°C scenario | 1.5°C scenario | |

|---|---|---|---|---|

| Transition Risk | Risks associated with changes in policies and regulations, technology, market, and reputation, arising from the transition to a decarbonized society | IEA (International Energy Agency) World Energy Outlook 2023 |

IEA STEPS | IEA NZE2050 |

| Physical Risk | Risks resulting from the consequences of changes in the climate itself | IPCC (Intergovernmental Panel on Climate Change) Sixth Report |

IPCC SSP5-8.5 | IPCC SSP1-1.9 |

IIF assesses the financial impact on the entire portfolio based on climate change-related scenarios, with 2030 as the medium term and 2050 as the long term. Based on the assessment results, IIF's efforts and measures to respond to potential risks and opportunities are as described below.

Scenario Analysis: Qualitative/ Quantitative Analysis

This table can be scrolled sideways.

| Classification | Risk / Opportunity Items | Financial impact | IIF’s efforts and measures | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Change in cash flow (qualitative expression) | Risk / Opportunity | 4°C scenario | 1.5°C scenario | 4°C scenario | 1.5°C scenario | ||||||||

| Medium term 2030 | Long term 2050 | Medium term 2030 | Long term 2050 | Medium term 2030 (million yen) |

Long term 2050 (million yen) |

Medium term 2030 (million yen) |

Long term 2050 (million yen) |

||||||

| Transition Risks / Opportunities | Policy and Regulations | Increase in legal compliance costs | Increase in CO2 emissions costs due to introduction of CO2 emissions regulations and carbon tax | Risk | Small | Small | Small | Middle | ▲ 18 | ▲ 34 | ▲ 487 | 0 |

|

| Increase in costs of acquiring environmental certifications/energy conservation ratings | Risk | Small | Small | Small | Middle | - *1 |

- *1 |

▲ 9 | ▲ 17 |

|

|||

| Improvement of properties’ competitiveness through complying with laws and regulations | Opportunity | Small | Small | Middle | Large | - | - | - | - |

|

|||

| Technology | Diffusion of low-carbon / energy-saving technologies | Increase in costs to acquire ZEB properties, to convert existing properties to ZEB, and to research new technologies for introduction, etc. | Risk | Small | Small | Middle | Middle | - | - | - | - |

|

|

| Increase in retrofit costs associated with the introduction of energy-saving equipment and renewable energy and the promotion of carbon neutrality of real estate | Risk | Small | Small | Small | Middle | - *1 |

- *1 |

▲ 27 | ▲ 100 |

|

|||

| Reduction of utility costs through ZEB and energy-saving construction | Opportunity | Small | Small | Middle | Large | - *1 |

- *1 |

65 | 123 |

|

|||

| Soaring renovation / equipment costs | Increase in costs to rebuild or update facilities on introduction of new technology to meet future environmental needs | Risk | Small | Small | Middle | Large | - | - | - | - |

|

||

| Market & Reputation | Changes in market participants' awareness and perception towards climate change response | Increase in financing costs due to assessed high transition risk | Risk | Small | Small | Small | Middle | - | - | - | - |

|

|

| Changes in tenants’ needs for environmental performance | Decrease in lease revenue due to relative decline in environmental performance of owned properties and decrease in income due to stranded assets | Risk | Small | Small | Middle | Middle | - | - | - | - |

|

||

| Increase in appraised value and average rent for properties with high environmental performance | Opportunity | Small | Small | Middle | Large | - *1 |

- *1 |

1,410 | 2,640 |

|

|||

| Changes in social value for environmental performance | Increase in costs due to renewable energy installation | Risk | Small | Small | Middle | Middle | - | - | - | - |

|

||

| Lower financing costs through green finance | Opportunity | Small | Small | Middle | Middle | - *1 |

- *1 |

1 | 2 |

|

|||

| Increase in asset value through improvement of greening performance | Increase in financing costs from investors and financial institutions due to inability to obtain environmental certifications and evaluations from global evaluation agencies | Risk | Small | Small | Middle | Middle | - | - | - | - |

|

||

| Increases in value for environmental performance | Decrease in property value and average rent due to lack of progress in acquiring environmental certifications such as ZEB and DBJ Green Building certification | Risk | Small | Small | Middle | Large | - | - | - | - |

|

||

| Increases in number of companies going carbon neutral | Decrease in occupancy rates of buildings due to lack of energy creation and energy conservation function | Risk | Small | Small | Small | Middle | - | - | - | - |

|

||

| Decrease in brand value due to underdevelopment of green buildings | Decrease in rent premiums due to brand value decline of building types with no environmental certification programs | Risk | Small | Small | Small | Middle | - | - | - | - |

|

||

| Physical Risks / Opportunities | Acute | Increase in typhoons, torrential rain, storm surges, floods, and inundation | Increase in costs for repair, proactive measures and insurance premiums due to inundation of owned properties | Risk | Small | Middle | Small | Small | ▲ 130 | ▲ 180 | ▲ 124 | ▲ 130 |

|

| Loss of business opportunities due to inundation of owned properties | Risk | Small | Middle | Small | Small | ▲ 7 | ▲ 9 | ▲ 6 | ▲ 7 |

|

|||

| Decrease in property values with high inundation risk | Risk | Small | Middle | Small | Small | - | - | - | - |

|

|||

| Further improvement of market competitiveness through highly resilient portfolio | Opportunity | Small | Middle | Small | Small | - | - | - | - |

|

|||

| Compensation for losses by insurance | Opportunity | Small | Middle | Small | Small | 48 | 66 | 46 | 48 |

|

|||

| Chronic | Progressive rise in average temperatures | Increase in maintenance and repair costs for air conditioning and utility costs due to increasing cooling demand | Risk | Small | Middle | Small | Small | - | - | - | - |

|

|

| Progressive rise in sea level | Increase in repair costs and property insurance premiums for countermeasures against sea level rise, etc. | Risk | Small | Middle | Small | Small | - | - | - | - |

|

||

Major reduction measures

| Contribution to Reductions | |

|---|---|

| Introduction of renewable energy measures such as solar power | 44% |

| Replacement with high-efficiency lighting, air conditioning and other energy-saving equipment | 39% |

| Contribution to Reductions | |

|---|---|

| Introduction of renewable energy measures such as solar power generation, switching to alternative energies | 35% |

| Replacement with high-efficiency lighting, air conditioning and other energy-saving equipment | 32% |

| Reduction of Categories 1, 2 and 3 emissions through use of environmentally considerate products and services, expectations for infrastructure development, and adoption of environmentally considerate building materials and construction technologies | 29% |

| Reduction of Scope 3 emissions through engagement with tenants and suppliers | - |

| Change in energy supply (assumed to progress from 2040 onward toward 2050) | - |

| Residual emissions (below 10%) will be neutralized by negative emissions | - |

IIF has set targets for greenhouse gas emissions reduction toward realization of 2050 net-zero target. Based on validation by a third party specialized institution, a target has been set for reduction of absolute GHG emissions by 42% compared to FY2021 levels by 2030. The target has been certified as a science-based target by the Science Based Targets initiative (SBTi).

Actual GHG emissions from base year

This table can be scrolled sideways.

| FY2021 | FY2022 | FY2023 | FY2024 | Target | ||

|---|---|---|---|---|---|---|

| Scope1 | 25,758 | 25,733 | 24,149 | 25,514 | SBT certified 2030 Reduce absolute Scope 1+2 emissions by 42%* |

|

| Scope2 (Market Based) | 16,282 | 29 | 97 | 208 | ||

| Scope1+2 | 42,040 | 25,762 | 24,246 | 25,721 | ||

| Scope3 | 140,724 | 156,937 | 144,681 | 166,658 | 2030 Scope 3 total emissions calculate and reduce* |

|

| Category 1 Purchased goods and services | 6,707 | 7,349 | 7,085 | 7,809 | ||

| Category 2 Capital goods | 13,327 | 17,307 | 23,113 | 16,484 | ||

| Category 3 Fuel- and energy-related activities not included in Scope 1 or 2 | 27,392 | 46,241 | 46,124 | 48,537 | ||

| Category 5 Waste generated in operations | 14,439 | 13,194 | 557 | 13,354 | ||

| Category 6 Business travel | 1 | 1 | 1 | 1 | ||

| Category 7 Employee commuting | 1 | 1 | 1 | 1 | ||

| Category 12 End of life treatment of sold products | 0 | 137 | 156 | 322 | ||

| Category 13 Downstream leased assets | 78,802 | 72,655 | 67,644 | 78,042 | ||

| Category 15 Investments | 56 | 54 | 0 | 2,109 | ||

| Total | 169,049 | 170,187 | 168,927 | 192,380 | 2050 Net-zero |

For results and progress since 2015, please refer to “Environmental Performance”. For other indexes and goals, please refer to “Materiality and KPIs” in Sustainability.